How to Configure Tax

Introduction

Managing taxes correctly in your store is essential to ensuring compliance with local tax regulations and providing a seamless experience for your customers. In this guide, we will walk you through how to set up tax for individual countries, how tax is applied to B2B orders, and how to remove tax settings when needed.

How Tax Is Applied to B2B Orders

For B2B transactions, tax is generally not applied to orders placed by businesses outside of the country your store operates in. Instead, the responsibility for tax calculations and payments falls on the purchasing business in their respective country. This means:

- If your business operates in Germany, only German-based retailers will see VAT applied at checkout.

- Orders from retailers in other countries will have 0% VAT, as they are responsible for handling tax in their own jurisdiction.

How to Set Up Tax for Individual Countries

Accessing Tax Settings

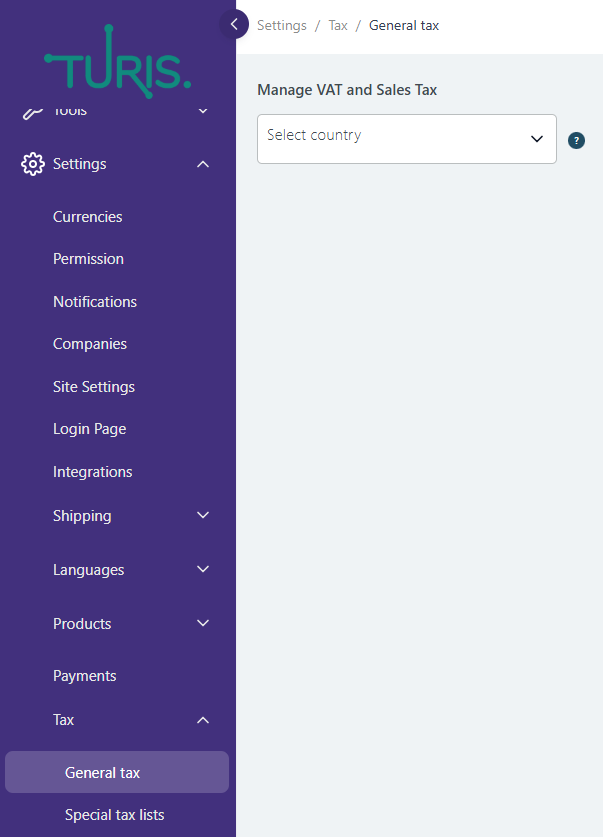

To configure tax settings, follow these steps:

- Click on ⚙️ Settings in the menu on the left-hand side.

- Select General tax.

Your tax settings window will appear.

Adding a Country-Specific Tax

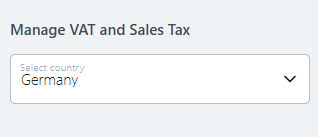

- Click on the dropdown menu to unfold a list of available countries.

- Select the country for which you want to configure tax.

🔔 Important: You should only set up tax for the country where your business is registered. For example, if your company is based in Germany, only set up the German tax.

💡 Orders to customers in other countries will have 0% tax, as the customer making the purchase is responsible for calculating and paying taxes in their country.

Following this example, let's select Germany:

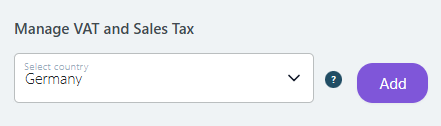

- Click the green "Add" button to add Germany.

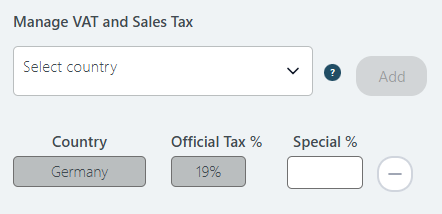

- Germany will now appear in the list with the official VAT rate of 19%, displayed in a greyed-out box.

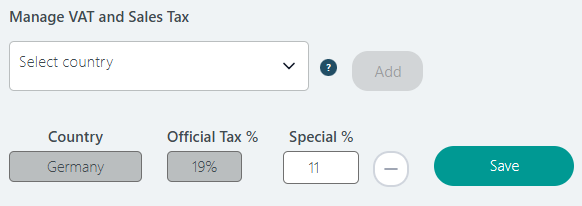

Setting Up a Special Tax Rate

If you need to apply a different tax rate for specific cases, you can enter a custom percentage in the "Special %" field.

After setting the special tax percentage, click "Save" to store your changes.

For example, if you set a special tax rate of 11%, all German retailers shopping in your store will see their total price including 11% tax.

🔔 Note: Retailers who do not have Germany selected as their country will only see a total price excluding VAT.

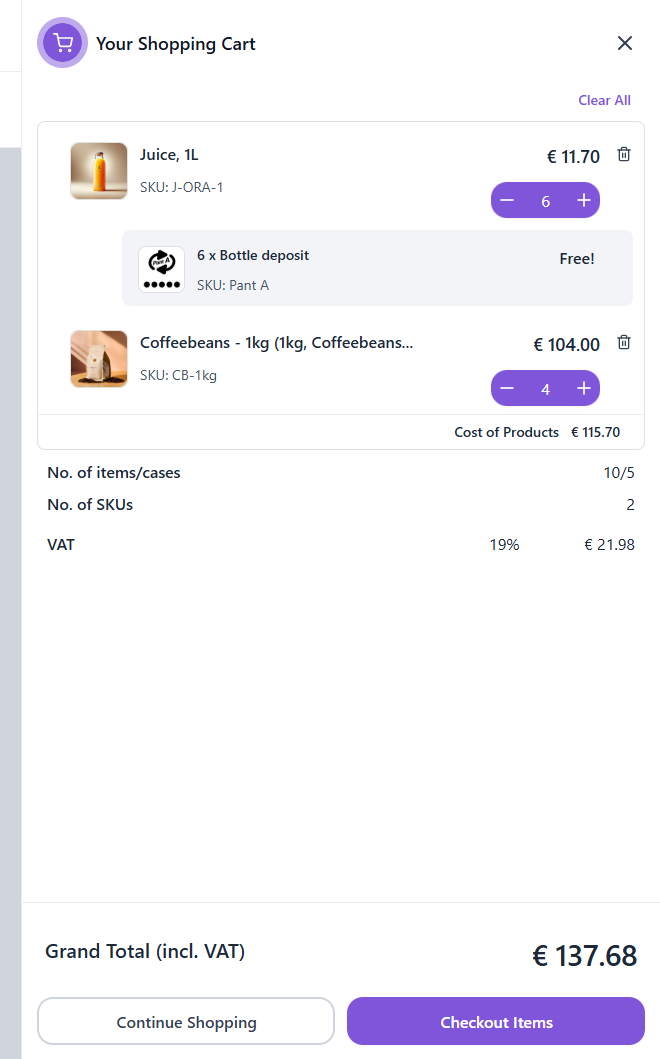

How Tax Appears in Checkout

When a customer reaches checkout, they will see:

- A Subtotal (excluding VAT)

- A Total (including VAT, if applicable)

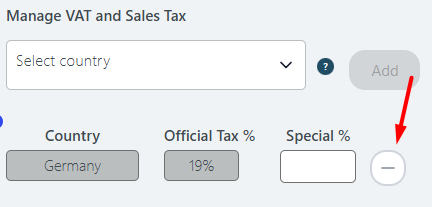

Removing Tax Settings

If you need to delete a tax setting (e.g., the German tax), follow these steps:

- Click on the "- / minus" button on the right-hand side of the tax setting.

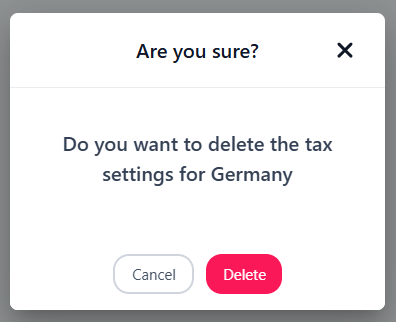

- A pop-up message will appear asking for confirmation.

- Click the red "Delete" button to remove the tax setting.

By following these steps, you can ensure that your tax settings are configured correctly and remain compliant with your business’s tax obligations.